The constitution of India has given every person the right to freedom of speech and expression, it is a fundamental right and hence highly valued but the constitution with all its power also puts some restrictions on it. One has the right to protect his reputation but cant tarnish someone else’s at the same time. This injury to a person’s reputation is called defamation. It is defined under Sec 499 of Indian penal code as Whoever, by words either spoken or intended to be read, or by signs or by visible representations, makes or publishes any imputation concerning any person intending to harm, or knowing or having reason to believe that such imputation will harm, the reputation of such person, is said, except in the cases hereinafter expected, to defame that person.

Explanation 1

Anything imputed or published against a deceased person shall be derogatory to him and also shall hurt the feelings of his family or other near relatives will amount to defamation

Explanation 2

Anything imputed, published against a company or an association or collection of persons as such may amount to defamation.

Explanation 3

An imputation in the form of an expression, a remark or a hint typically a disparaging one. If one can prove that even though the statement published does not appear defamatory prima facie but by the circumstances and nature of its publication is derogatory then the offence of defamation may be said to have taken place.

Explanation 4

Anything imputed or published which directly or indirectly, lowers the moral or intellectual character of that person, or lowers the character of that person in respect of his caste or of his calling, or his credit, or causes it to be believed that the body of that person is in a loathsome state, or in a state generally considered as disgraceful amounts to defamation.

Any false and unprivileged statement published or spoken deliberately, intentionally, knowingly to damage someone’s reputation is defamation. It is pertinent to note that defamation is not just a wrong done by a person to another’s reputation by words, written or spoken, but can also be done in signs, or other visible representation.

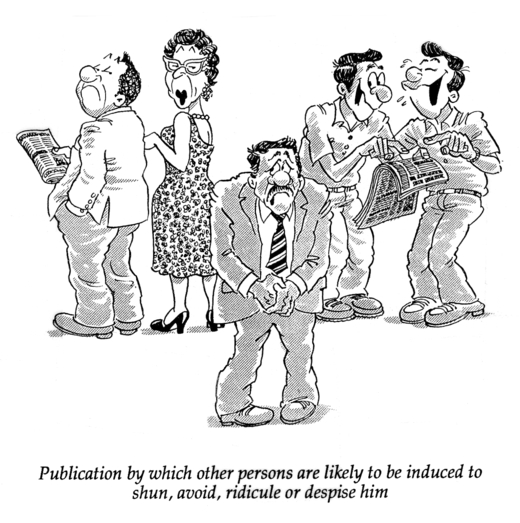

To prove a defamation case, there are three most essentials. The foremost thing is that the statement spoken, written, or intended has caused injury or lowered the other person’s reputation. Secondly, it must prove that the statement thus spoken or published is directed towards the plaintiff. And thirdly, the statement must be published. It must be read by a third party, for, it is the opinion held by the person defamed by others that matters; insults directed to the plaintiff himself do not in themselves constitute defamation, the tort is not primarily concerned with the plaintiff’s wounded feelings.

There are two types of defamation under English law, libel, and slander.

Slander is the statement made through some spoken words or some transitory form, whether visible or audible such as gestures, hissing, or such other things. It appears to be a civil wrong but the words made may be blasphemous, seditious or obscene and this is a criminal offence under Section 499 of IPC.

Libel is a representation made in some permanent form, for example writing, printing, or statute. In Indian law there is no distinction made between libel and slander; both are treated as criminal offenses under section 499 of IPC. It is a criminal offence as well as a civil wrong.

An aggrieved person can avail both the remedies civil and criminal. The party in no way is compelled to choose between the two remedies. And hence there are two types of defamation, civil defamation, and criminal defamation. Let’s go through them in detail.

In a Civil Defamation case, monetary compensation can be claimed, provided the statements made are false and without the consent of the alleged defamed person. Mere vague or general statements will not amount to defamation; the injury to one’s reputation should be visible from a common man’s eye. It must be exposed to a third party, either orally or published. And if any statement harming the person’s reputation is made in it, it will constitute defamation even if it was sent as a private letter, since the requirement of a third person is essential to prove a defamation case.

Under a Criminal Case, the intention to defame is necessary. There must be malicious intent to put down another person without any reasonable doubt. Section 499 of the Indian penal code defines defamation and also states down its exceptions. While Sec 499 defines Defamation, Section 500 on the other hand provides for the punishment to a person committing the offense. Section 500 of the Code punishes defamation with simple imprisonment which may extend to two years, or fine or both. The Indian Penal Code also punishes printing or engraving matter known to be defamatory or sale of such printed or engraved substance containing defamatory matter about any person in the same manner of punishing defamation. Defamation is a bailable, non-cognizable, and compoundable offence, which means no police can register a case and start an investigation without the court’s permission. If a person is found guilty under sections 499 and 500 of IPC, he could be sent to jail for 2 years. The main difference between criminal and civil defamation is that an accused person can be sentenced to jail under the provisions of criminal defamation but in civil defamation provisions a person can only claim damages from the accused person.

Now that we’ve understood what exactly defamation is, let us get an insight into a landmark judgment regarding the same. In the case of Ram Jethmalani v/s Subramaniam Swamy, the defendant i.e Subramaniam Swamy passed a comment which stated that Mr. Jethmalani has been receiving money from the LTTE which is being deposited in his son’s account in Citibank, for such a grave allegation a suit was filed by Mr. Jethmalani, stating that the defendant was guilty of vicious and gross libel. Plaintiff claimed that he has a good reputation in India and also outside, and these types of statements damage the personal, political and professional reputation for which he claimed exemplary damages. Even though the defendant claimed that his statement was not with malicious intent, he could not prove the truthness of it. The Judge declared that this is prima facie defamatory. The statement was irrelevant to the situation, actual malice on part of the defendant was well established which harmed the image of the plaintiff at large and such allegations destroyed the personal and political reputation. Compensation of 5 lacs was awarded.

Defamation to one’s reputation can destroy his career, and hence defamation laws have commenced so that these cases can be legally dealt with and one does not misuse his right of freedom of speech and expression. In the case mentioned above, Mr. Ram Jethmalani is a very reputed person in India, he has served as the Law Minister and also the minister of Urban Development, statements made against him are of grave importance and are always to be taken seriously. Remarks made by Subramaniam Swamy were a dagger to his reputation because LTTE is a banned organization and had been declared a terrorist group by many countries. and being associated in any way with a terrorist organization leads to the loss of one’s reputation, even though it is proven false. Hence, Mr. Jethmalani deserved to be rightly compensated. A person takes years of effort and hard work to make a reputation in the society that he lives in, and it is rightly said that a name is built over time but can be very easily damaged and due to this a Court has a huge responsibility to judge the person fairly. The court must watch the thin line between the right to freedom of speech and one’s reputation at harm because to one, his reputation is everything.

In another case, Balraj Khanna & Ors. Vs. Moti Ram, the Respondent (Moti Ram) filed a complaint against the Appellant (Balraj Khanna) under section 500 of IPC alleging that appellants made certain defamatory comments regarding his character and working in the government office and that caused the suspension of the respondent. Respondent during December of 1964 was working as the liaison officer in Municipal Corporation in Delhi, appellants were members of the standing committee at that time. Appellants and respondents were not on good terms with each other and appellants many times tried to cause harm to the respondent on many issues. Appellant Balraj Khanna was having major control over the standing committee at that time so he used his influence on the committee against the respondent, calling the committee to pass a resolution for the suspension of the respondent. Meeting held on December 10th of 1964 in which many officers, as well as media personals, were called and appellants made serious allegations against the respondent in front of all those present and passed the resolution for suspension, which decrement the value of the character of the respondent in front of people who were present. The supreme court in agreement with the reasoning of the High Court on this aspect held that the High Court has made a correct approach when it held that the evidence implicates all the members of the Standing Committee, including the appellants in the charge of making the statements alleged to be defamatory. And the question of the application of the Exceptions to Section 499 I. P. C. does not arise at the pretrial stage, it will have to be gone into during the process of trial of the complaint. The appeal failed and was dismissed.

Certain exceptions have been provided under Section 499 of the IPC, they are as follows:

1. Truth for Public Good

If a statement published or made is true concerning any person and it is for the public good then it would not amount to defamation however derogatory it is.

2. Fair Criticism of Public Servants

Every citizen has a legal right to make true and fair statements on the public servants in the interest of the public.

3. Fair Comment on Public Conduct of Public Men Other Than Public Servants

A fair, honest and true criticism of servants of the public other than government employees will not amount to defamation rather succeed the test of fair comment.

4. Publication of Report of Proceedings of Courts of Justice

As the Judicial proceedings are a matter of public interest, It is essential that reports of these proceedings are made with utmost honesty, free from malafide, dishonest and incorrect information. It must contain all information precisely how they occurred. This would also not amount to defamation.

5. Comment on Cases

It would not amount to defamation if an opinion respecting the merits of any civil or criminal case decided by the court is expressed in good faith. This exception provides Protection to case comments of the decisions that have been adjudicated upon

6. Merits of Public Performance/Literary Criticism

The society must have the opportunity to freely criticise the performances or literary work that is submitted to its judgement. A fair and honest opinion respecting the merits of any performance which the author himself has submitted will not amount to defamation.

Ingredients that need to be fulfilled for this exception:

a. An invitation from the author to express your opinions on his work is necessary.

b. The criticisms must be pertinent to the standard of the performance and not on the basis of capability to do the same or not.

c. The statement must be made in good faith.

7. Censure by One in Authority

It is not defamation if a person having authority over another, either conferred by law or arising out of a lawful contract, to pass in good faith any censure. Illustration A Judge censuring in good faith the conduct of a witness, a parent censuring in good faith a child in the presence of other children.

Ingredients that need to be fulfilled for this exception:

a. The person making the statement must be in a position of authority over whom the statement is made.

b. The statement needs to be made in good faith.

8. Complaint to Authority

It would not amount to defamation if a complaint in good faith is made to a person who is in authority to punish the other.

Ingredients that need to be fulfilled for this exception:

a. The statement must be made to a person in authority

b. The statement must be made in good faith.

9. Imputation for Protection of Interests

This exception is similar to the first exception which deals with the public good. The Supreme Court in the case of Harbhajan Singh v State of Punjab held that this exception has to be applied by keeping in mind the facts and circumstances of each case which includes, the alleged malice, due care and attention where defamation is alleged. It is not enough on the part of the accused that he believed the statement to be true. Under this exception, even if good faith has to be established, the imputation must be made for the protection of interest of the person making it.

10. Caution in Good Faith

Under this exception, it is necessary to prove that the imputations were a result of ‘good faith’ and were meant for ‘public good’. One is not supposed to prove the same beyond reasonable doubt and the mere probability that he did not commit the offence is sufficient.