Brief Note on Summary Suits and Summons

A Summary suit procedure is provided under Order XXXVII of the Code of Civil Procedure, 1908. It is a procedure that takes place faster compared to the ordinary procedure because in this procedure the court has the right to pass judgments without hearing the defense of the defendant. Even though this may seem like a violation of the rule Audi Alteram Partem which means that the court shall hear the other side as well, this summary procedure is specific to only those cases where the defendant has no defense and applies to only limited subject matters. The main purpose of a summary suit is to ensure that the proceedings and the disposal of the suit are taken place expeditiously to prevent unreasonable delay and obstruction by the defendant who already has no defense.

These summary suits are only limited to cases in which the plaintiff seeks to recover a debt or liquidated demand in money payable by the defendant which may be with or without interest, or for the recovery of immovable property which may be with or without a claim for rent or mesne profits, by a landlord against a tenant whose term has expired or has been duly determined by notice to quit, or has become liable to forfeiture for non-payment of rent, or against persons claiming under such tenant; and also against documents such as a bill of exchange, hundies, and promissory notes.

Such a suit can be instituted in High Courts, City Civil Courts, Courts of Small Causes and any other court notified by the High Court. The high court has the power to vary, enlarge and even restrict the category of suits to be brought under this order. A bill of exchange is a written unconditional order by one party to another to pay a certain amount either immediately or on a fixed date in exchange for goods and services. While hundi is also an unconditional order, it is slightly different from a bill of exchange because here party no.1 directs party no.2 to pay a certain amount to party no.3. It is an order made in writing by party no.1 and given to party no.2. It is usually used for credit purposes. A promissory note is an unconditional written promise to pay a certain amount mentioned to any person presenting the note. A liquidated demand in money is demand for a fixed sum of money.

Rule 2 of Order XXXVII mentions the institution while Rue 3 lays down the procedure. Rule 2 specifies the nature of the suit as well as also mentions that The summons of the suit have to be in the way specified in form no. 4 appendix B and the defendant does not have the right to defend himself unless he has made an appearance in the court. The first and foremost procedure after institution of the summary suit is that the defendant is to be served with a copy of the summons and within 10 days of such service the defendant is supposed to make an appearance, either himself or through his advocate, and shall also file a notice of appearance in the court. Further to this step, the plaintiff shall serve the summons of judgment mentioned in Form no. 4A in appendix B along with an affidavit verifying the cause of action and the amount claimed and stating that in his belief there is no defense to the suit. Within 10 days of service of such summons of judgment, the defendant has to apply for leave to defend the suit. Leave to defend may be granted to him unconditionally or upon such terms as may appear to the Court or Judge to be just.

The defendant can be granted leave to defend unconditionally if he satisfies the court that he has a substantial defense, if he raises triable issues indicating that he has a fair or reasonable defense, he may be granted conditional leave if the trial judge doubts the defendant’s good faith or if the defendant raises a defense which is plausible but improbable and he will not be granted any leave at all if the defendant has no substantial defense and raises no genuine triable issue or if the amount claimed by the plaintiff is admitted and due by the defendant but has not yet been deposited in the court. And at the time of hearing of such summons for judgments, If the defendant has not applied for leave to defend, or if such an application has been made and refused, the plaintiff becomes entitled to the judgment forthwith. And If the conditions on which leave was granted are not complied with by the defendant then also the plaintiff becomes entitled to judgment forthwith. If the court deems fit, it can grant leave to the defendant and set aside the decree, the court may also ask for the bills, notes, hundis, etc to be deposited with the officer of the court. Further Sub-rule (7) of Order 37 provides that under this order the procedure in summary suits shall be the same as the procedure in suits instituted ordinarily.

Rule 17 of Order 5 of The Code Of Civil Procedure, 1908 lays down the procedure when the defendant or his agent refuses to sign the acknowledgment or accept service, or where the serving officer, after using all due and reasonable diligence, cannot find the defendant, who is absent from his residence and there is no other person present to accept service of the summons on his behalf, the serving officer shall affix a copy of the summons on the outer door or some other conspicuous part of the house in which the defendant ordinarily resides or carries on business, and shall then return the original summons to the Court attaching a report stating that he has affixed the copy and mention the circumstances under which he did and also the name and address of the person by whom the house was identified and in whose presence the copy was affixed. Then the court shall examine the serving officer on oath, may make such further inquiry in the matter as it thinks fit; and shall either declare that the summons has been duly served or order such service up to his discretion. Rule 20 of order 5 speaks about Substituted service. Wherein if the Court is satisfied/believes that the defendant is intentionally avoiding service, or the summons issues cannot be served in the ordinary way, the Court shall order the summons to be served by affixing a copy in some conspicuous place in the Court-house, and also upon some conspicuous part of the house (if any) in which the defendant is known to have last resided or carried on business or in such other manner as the Court thinks fit. If the Court orders service by an advertisement in a newspaper, the newspaper shall be a daily newspaper circulating in the locality in which the defendant is last known to have actually and voluntarily resided or carried on the business. Service which has been substituted shall be treated as if it had been made on the defendant personally. The court shall also fix a time for the appearance of the defendant as per its discretion. Under rule 21 of order 5 covers service of summons where the defendant resides within the jurisdiction of another Court in which summons may be sent by the Court whether the defendant resides within or without the State, either by one of its officers or by post or by such courier service as may be approved by the High Court or by fax message or by Electronic Mail service or by any other means as may be provided by the rules made by the High Court to any Court having jurisdiction in the place where the defendant resides. By rule 25 of order 5, summons can be sent if the defendant resides out of India and has no agent. The summons shall be addressed to the defendant at the place where he is residing. for example, if the defendant resides in Bangladesh or Pakistan, the summons, together with a copy may be sent to any Court in that country (not being the High Court) having jurisdiction in the place

where the defendant resides.

Order 37 of the Code of Civil Procedure, 1908, has elaborately laid down the mechanism for speedy litigation; it enables the plaintiff to recover his money where the defendant has admitted his liability. It makes sure that through this procedure there is no unreasonable delay on the part of the defendant as seen in actual practice that the only notice of the defendant is to prolong the case. The plaintiff is entitled to judgment unless the defendant has a solid reason to defend his case in these matters. In a summary suit, the plaintiff almost immediately receives relief on which he has prayed before the court. Thus, the issuance of summons twice in a summary suit defeats the whole purpose of an expeditious trial by the court.

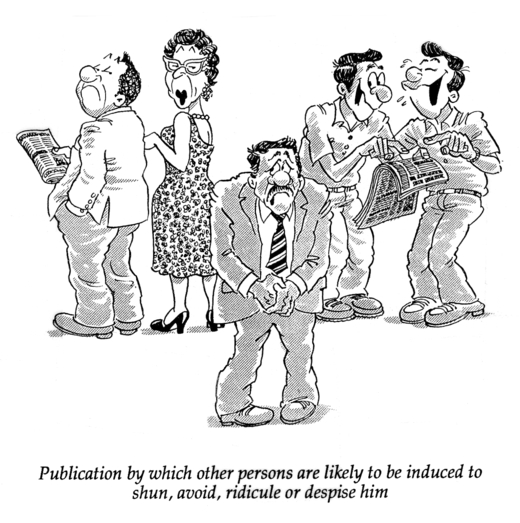

It is very important that a person gets justice and on time. Indian legal mechanism is particularly infamous for this particular aspect of delay in providing justice which ultimately defeats if not fully, at least partially the purpose of the whole trial. If a summary suit trial is not made in a speedy manner, it cannot be deemed as fair. It is unimaginable how much loss our nation and the people are suffering, because of the delay in disposing of the cases. Innocent people are the worst affected, who depend on courts for getting justice, which he can never calculate as to when so-called justice is finally arriving. None can compute his worries and the frustrations. Such sufferings and hardships only conclude that Delayed Justice is Denied Justice. It is obvious to say that inordinate and unnecessary delay defeats the end of justice. Even though The Apex Court in its various landmark judgments held that “right to speedy trial is a fundamental right which is implicit under Art. 21 of the Constitution”, it is hard to see courts actually working for it. While delivering Summons, it is a process to compel the attendance of the defendant in the matter at point to appear and file his answer which generally people try to evade the process of summons just to buy some time. It delays the speedy trial. Even though the whole purpose of a summary suit is to expeditiously complete the process and provide justice, this process of issuing summons twice only delays the process which results in people not believing in our justice system anymore. While the ‘service of summons’ appears to be simple and straightforward in theory, it has in fact turned tedious in practice. The problem of delay and huge arrears stares us all and unless we can do something about it, the whole system would get crushed under its weight. We must guard against the system getting discredited and people losing faith in it and taking recourse to extra legal remedies with all the sinister potentialities. The Indian judiciary is the last hope for citizens of India. There is a need for the judiciary to bring back people’s faith in them, it still has time to make amends for the people of the nation.

Advocates, Arbitration Lawyers, Consulting Lawyers and IPR Attorneys

Useful Links

17/2 & 3, Parvati Niwas, Juhu Village, First Floor, Sector – 11, Vashi, Navi Mumbai – 400703

@ E-mail:email@fireflieslegal.com

@ (M): 8286000868

@ (O): 7400236789/ 7208790701/ 7208790702/ 7208790703/ 7208790705